Unlocking your financial future often involves building smart decisions about your savings. One powerful tool in your arsenal is the 401(k), a retirement savings plan that can significantly enhance your long-term wealth. Recognized as a cornerstone of financial planning, the 401(k) allows you to invest pre-tax income, significantly reducing your current tax burden. This can free up more money for other expenses or even additional contributions to your retirement savings.

- Moreover, many employers offer matching contributions to 401(k)s, essentially doubling your investment and providing a substantial financial incentive.

- Understanding the various types of investments available within a 401(k), such as stocks, bonds, and mutual funds, is essential to building a diversified portfolio that aligns with your risk tolerance and long-term goals.

Always bear

that seeking a qualified financial advisor can provide tailored guidance on maximizing your 401(k) for retirement success.

Leading 401(k) Providers for Every Career Stage

Navigating the world of retirement savings can feel overwhelming, especially when you're just starting your career or nearing retirement. A top-rated 401(k) plan can make a significant difference to your long-term financial security. Whether you're a young professional or a seasoned veteran, finding the right 401(k) plan tailored to your needs is crucial.

Here are some factors to consider when selecting a 401(k) plan: investment choices, fees, matching contributions from your employer, and customer service. Comparing different plans can help you identify the best fit for your financial goals.

Once you've considered these factors, you can start to explore some of the top-rated 401(k) plans available.

- Consider employer-sponsored 401(k) plans, as they often offer attractive matching contributions.

- Utilize online tools to compare different 401(k) plans and fees.

- Don't hesitate to request advice from a financial advisor if you need help choosing the right plan for your individual needs

By taking the time to carefully consider your options, you can find a top-rated 401(k) plan that will help you build a secure and comfortable retirement.

Choosing the Best 401(k) Plan for Your Needs

Deciding on a suitable 401(k) plan can feel overwhelming. Evaluate your retirement aspirations carefully to identify what's most important to you. Do you prioritize cost-effectiveness? Or is high growth potential a top focus? Analyzing various plan options and their characteristics will help you make an informed decision.

- Investigate different investment choices offered by the plans.

- Analyze the employer matching contributions provided by each plan.

- Talk to a retirement specialist for personalized recommendations.

Remember, the ideal 401(k) plan is the one that meets your specific requirements and helps you attain your financial objectives.

Maximize Your Retirement Savings: Top 401(k) Strategies

Securing a comfortable retirement starts with smart savings. A 401(k) plan is a powerful tool to achieve your financial goals, but maximizing its potential requires thoughtful approaches. Here are some key tips to help you unlock the full power of your 401(k):

- Participate in the maximum amount

- Spread your investments across different asset classes

- Monitor your portfolio periodically

- Maximize any employer grants

Grasping 401(k) Plans: A Comprehensive Overview

A 401(k) plan is a retirement account that allows employees to defer taxes on investments made for their future financial security. Offered by many employers, a 401(k) plan provides a valuable chance to accumulate wealth over time through tax-advantaged {investments|. It's crucial for individuals to grasp the details of a 401(k) plan to make informed decisions about their retirement planning.

- Key features of a 401(k) plan include: contribution limits, vesting schedules, investment options, and employer matching programs.

- Appreciating these elements can help you make the most of your 401(k) plan and achieve your financial objectives.

Selecting 401(k) Investment Options: Finding What Works for You

When it comes to your savings plan, your 401(k) is a vital tool. But with so many asset allocation options available, choosing the right path can feel overwhelming. The key is to grasp your comfort level. Are you comfortable with changing markets or more info do you prefer a more predictable approach? Consider your time horizon as well – are you saving for retirement in 30 years?

- Diversify across different asset classes like stocks, bonds, and real estate.

- Research the fees associated with each investment option.

- Seek advice a financial advisor if you need help navigating the best options for your specific situation.

Remember, your 401(k) is a long-term investment. By making strategic choices, you can set yourself up for a secure financial future.

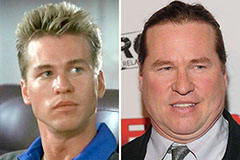

Val Kilmer Then & Now!

Val Kilmer Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!